The Tweezer Bottom: Highly Accurate Reversal Pattern

The tweezer bottom candlestick pattern is normally used to find the reversals from the trading market. In this article, we will discuss the importance of this pattern and how we can easily trace the tweezer bottom pattern and use it for profitable trading.

Focus Outline:

1- What is a tweezer bottom?

2-How does a tweezer bottom form?

3-Why tweezer bottom is important for a trader?

4-How to find the tweezer bottom pattern on the chart?

5- What time frames work well with this candlestick pattern?

6-Can we find this pattern in all types of markets?

7-How to take the right trade with the help of a tweezer bottom pattern?

8- Important tips for using this candlestick pattern

9-Common Mistakes to Avoid while Trading Tweezer Bottoms

What is a Tweezer Bottom Pattern?

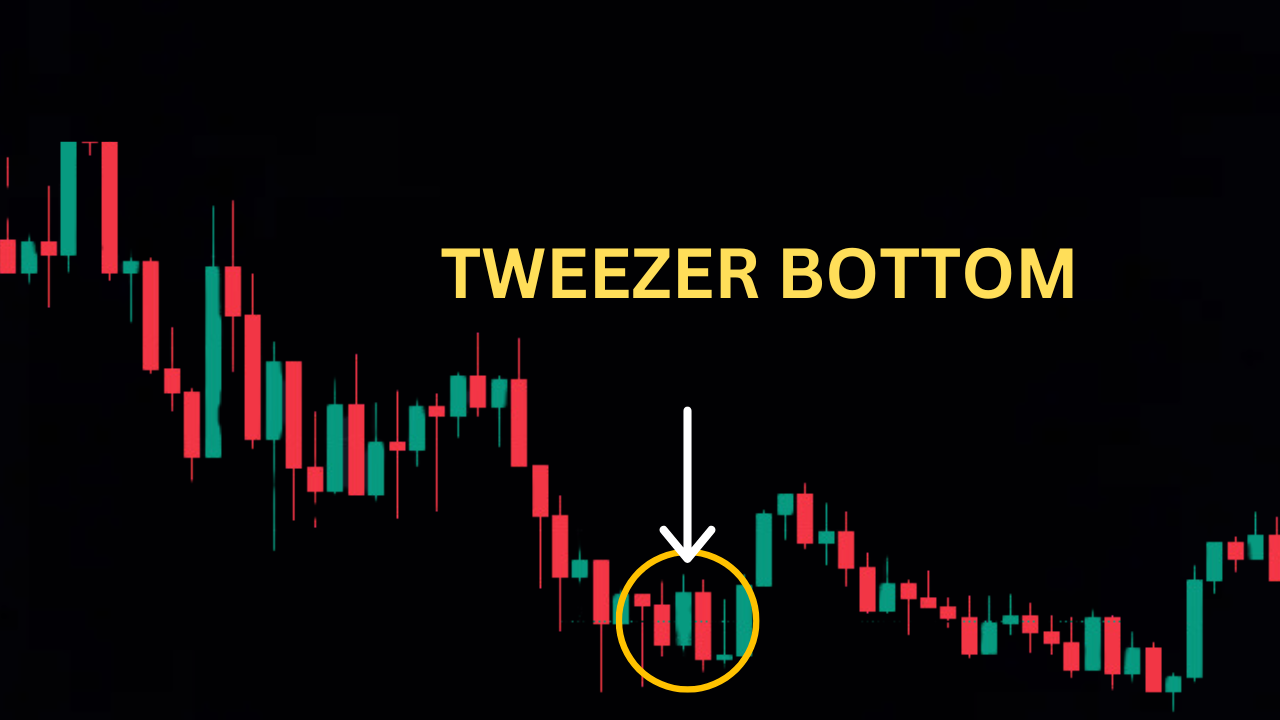

The tweezer bottom pattern consists of two or more candles with almost the same low prices. This pattern gives an idea that the price is likely reached to a bottom and a reversal to the upside can be seen. Traders should find this candlestick pattern at the end of the downward trend.

When we see such a pattern on our chart it’s a sign that the market can find the support on this price level. This type of support area works much better than normal support levels. If you see that the price is unable to break this price area below then it’s a clear upward signal.

How does a Tweezer Bottom form?

The tweezer bottom pattern normally forms after two consecutive sessions of trading. The first session will consist of the bearish candlestick indicating the downward sell pressure in the market. On the other hand, the second session starts with a bullish candle stick pattern and the lows are very close or equal to the first candlestick low. It can be assumed that buyers have gained full control of the market and prices can go up.

These equal lows indicate that the market is unable to break that support below so the prices are most likely to go upward.

Why Tweezer Bottom is important for a trader?

The tweezer bottom is important for a trader because it represents the potential reversal in the price level. In this way, traders can enter into a buy position and can benefit from a good risk-to-reward ratio trade. Traders can set their stop losses at the low of the tweezer bottom.

How to find the Tweezer Bottom pattern on the chart?

- There should be two or more candles with almost the same lows.

- The first candlestick is normally bearish and the second one is a bullish candlestick.

- This pattern only appears at the end of a downward trend.

This trading pattern is highly reliable when we get a second confirmation from any volume indicator at this price level.

What time do frames work well with this candlestick pattern?

This type of candlestick pattern can appear in 1 minute to daily time frame. However, it is more reliable on higher time frames like h1, h4, daily and weekly. The higher time frames are less noisy and the support areas work much better than the lower time frames.

If you are an intraday trader then you can use the tweezer bottom pattern on the 15-minute and 1-hour charts but you should also take second confirmation from some other indicator.

Can we find this pattern in all types of markets?

The simple answer is Yes, we can expect this type of candlestick pattern in all types of markets including forex, crypto, stocks, and commodities. The main concept of this pattern is based on price action trading so it’s the same on all types of assets.

How to make the right trade with the help of the Tweezer Bottom pattern?

You need to follow the below steps to trade this pattern:

- First of all, you need to find this pattern at the end of a downward trend.

- You need to confirm this pattern with other leading indicators like MACD, RSI, and volume.

- We can take a buy position once the second candlestick is successfully closed above the high of the first candlestick.

- The stop loss rule is very simple as you can set it below the low of this pattern format.

Patience and discipline are the key to success followed by proper stop loss and risk management.

Important tips for using this candlestick pattern

If you are a beginner and you want to trade this pattern then you need to follow these important tips:

- You need to start finding these patterns on higher time frames because this can lead to avoiding many false signals.

- You should try this pattern trading first on a demo account and you should not risk your real money.

- You can try other indicators with this pattern for more reliable signals.

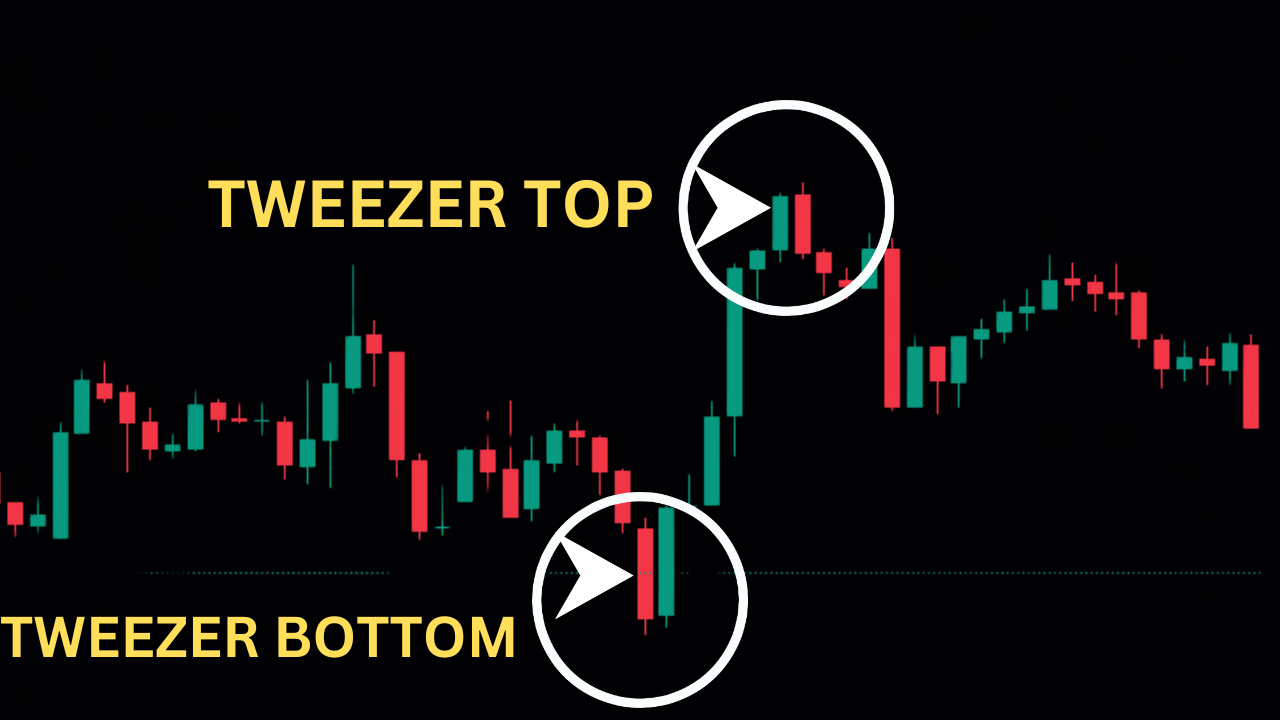

Difference between Tweezer Bottom vs. Tweezer Top

When we discuss about tweezer top it indicates the reversal from the upward trend. On the other hand, the tweezer bottom represents the reversal from the downward trend. In the case of the tweezer top, there must be two equally high candles. These both patterns are very important reversal patterns but they indicate opposite directions.

Common Mistakes to Avoid While Trading Tweezer Bottoms

Mostly traders enter into the buy position even if a pattern is yet for formed. Traders must always wait for the second candlestick to close above the high of the previous candlestick. Once it’s successfully closed above now it’s the right time to enter into a buy position.

Moreover, this pattern is less effective in choppy market conditions and is more reliable in a strong downward trend. A trader should not trade this pattern alone because it can lead to some false signals. For this, we should also consider other technical aspects for trade confirmation.

Conclusion:

In short, we can say that the tweezer bottom pattern is highly efficient, and it’s a must-knowledge for a trader who is willing to trade forex, crypto, and stocks. This pattern provides the traders with efficient and accurate trading reversals. You can easily upgrade your decision-making with the help of this pattern and it will help you to increase your profitability.

Fx Mentor US Private Trading View Indicators:

Fx Mentor us provides high-class price action-based indicators. If you want to check more details about our indicator then click here

Fx Mentor Us Provide 1-hour market maker coaching to traders. Many traders have taken the sessions and now making great profits. You can check their feedback on our website. Click here