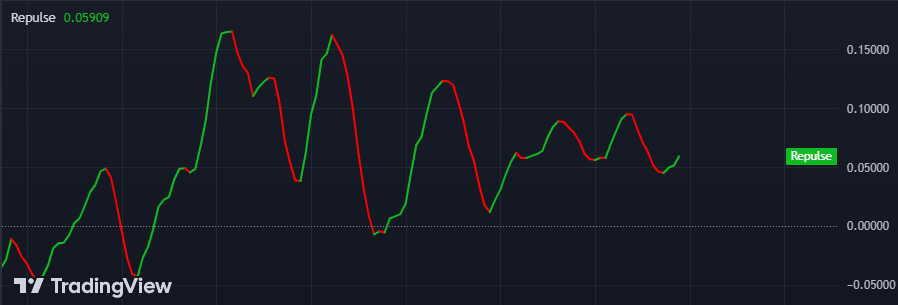

Repulse Trading Indicator by Everget (Trading View)

The repulse trading indicator is developed by the famous author everget. This indicator is specially designed for trading view platform. This indicator is widely used to understand the bullish and bearish pressure in the market. It helps traders to find the market sentiment and strength of buying and selling forces.

How does the Repulse Indicator Work?

The repulse indicator exactly works like other oscillators. There is a baseline line in this indicator and it operates above and below it. This indicator measures the difference between the moving average of the price and the actual price. The difference in this result is displayed with the help of bullish and bearish pressure with the help of three lines.

Short-term Pressure Line:

This line is very sensitive to fast changes in price. It calculates the immediate short-term bearish and bullish pressure. This line is highly helpful for scalpers.

Medium-term Pressure Line:

This line is less sensitive to the short-term line and it provides a bit wider view of the pressure in the market. This line is suitable for swing traders who look to make profits with medium-level movements in the market.

Longterm Pressure Line:

This line is very less sensitive than the other two lines. It is very helpful because it measures the overall pressure in the market on higher longer time frames. This line is a gift for those traders who want to hold trades for a longer period. This is best for long-term trading opportunities.

How To Use Repulse Indicator For Making Profits

We need to take care of the following points:

Find the Strength of a Trend:

When the repulse lines are above the zero level then it shows the bullish momentum in the market.The more high the line indicates the more buying pressure.

If the lines are below the zero level it indicates the bearish momentum. The lower the value means more strong trend in the market.

Divergence Trading:

A trader should find the bullish divergence when the price is making the lower lows. On the other hand, repulse indicators are making higher lows. This divergence tells us that bearish divergence is losing its strength. In that case, we can look for a bullish pullback.

Now let’s reverse this situation. When the price makes higher highs and the repulse indicator makes lower highs then its a message buyers are losing their strength. We can expect a bearish reversal in that case.

Conclusion:

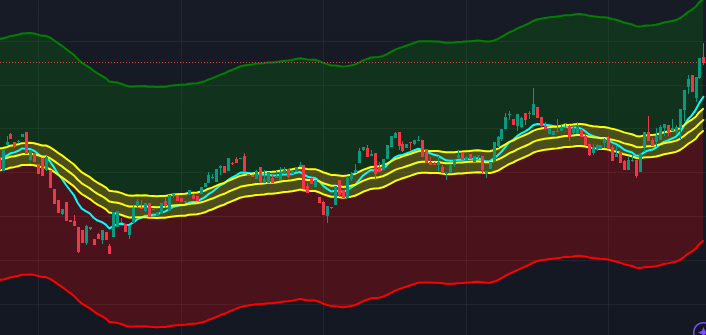

The repulse trading indicator is a great tool for traders. It provides us with an depth analysis of the market pressure. A trader can easily refine their strategy by following this indicator. The trader should consider other factors with this indicator like support and resistance.

You can try our private indicator for quick profits Click Here

Book Your 1 Hour Market Maker Coaching Session with FX Mentor US

Best Forex Broker: Click Here